Welcome to “Naijaclass Academy” For Waec Bookkeeping 2024 May/June Exam Answer

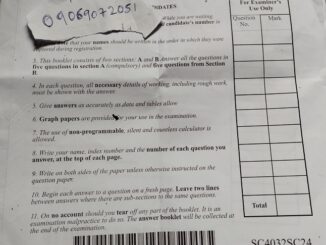

Date: Thursday, 9th May, 2024

Bookkeeping (Essay & Objective) 9:30 am – 12:20 pm

——————————

BOOK KEEPING OBJ

01-10: BBCDCBCCDB.

11-20: BACAADBDAA.

21-30: DBCDDBBBDB.

31-40: CCBBAAABDC.

(1a)

(PICK ANY TWO)

(i) Balancing of Accounts: A trial balance only ensures that the total of the debit balances is equal to the total of the credit balances. However, it does not ensure the accuracy of the individual account balances.

(ii) Detection of Errors: A trial balance may not detect certain types of errors, such as errors of omission, errors of commission, or errors of principle. These errors may not affect the equality of the debit and credit totals.

(iii) Identification of Fraud: A trial balance does not guarantee the detection of fraud. Fraudulent transactions can be recorded in a way that maintains the equality of the debit and credit totals.

(iv) Lack of Adjustments: A trial balance does not include any adjustments that may be necessary, such as accruals, prepayments, or depreciation. These adjustments must be made separately to ensure the accuracy of the financial statements.

(1b)

(PICK ANY THREE)

(i) Recording Transactions: The ledger is the primary record of all the business transactions, providing a detailed and organized account of the financial activities of the business.

(ii) Account Balances: The ledger allows for the easy identification of the current balance of any account, which is essential for making informed business decisions.

(iii) Financial Statements Preparation: The information in the ledger is used to prepare the financial statements, such as the income statement, balance sheet, and cash flow statement.

(iv) Audit Trail: The ledger provides a comprehensive audit trail, allowing auditors to verify the accuracy and completeness of the financial records.

(v) Management Reporting: The data in the ledger can be used to generate various management reports, such as sales reports, expense reports, and cash flow statements, which are essential for decision-making.

(2)

(a) The capital of Bimpe Enterprises at the start would be $N 2,000,000$, which is the initial amount invested to start the business.

(b) The financial year for Bimpe Enterprises would typically be from January 1st to December 31st, assuming it follows the calendar year as its fiscal year.

(c) Two items of expenditure for end of year adjustment might include provision for doubtful debts and accrued expenses. These adjustments are necessary to accurately reflect the company’s financial position at the end of the year.

(d) The item of expenditure subject to depreciation would be the cabinet bought for the business, as it is a tangible fixed asset that loses value over time due to wear and tear and usage.

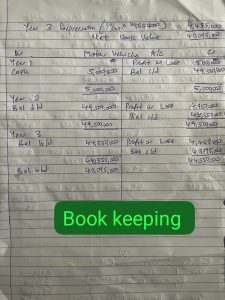

(3)

(PICK FIVE ONLY)

(i) Job Creation: Entrepreneurship leads to the creation of new businesses, which in turn create new job opportunities, reducing unemployment and stimulating economic growth.

(ii) Innovation: Entrepreneurs introduce new products, services, and processes, driving innovation and increasing productivity, which can lead to increased economic output and competitiveness.

(iii) Economic Growth: Entrepreneurship stimulates economic growth by creating new industries, increasing GDP, and generating revenue for the government through taxes.

(iv) Increased Competition: Entrepreneurship promotes competition, which leads to improved product and service quality, reduced prices, and increased customer satisfaction.

(v) Improved Standard of Living: Entrepreneurship leads to increased economic activity, resulting in improved standards of living, higher incomes, and better healthcare and education.

(vi) Encourages Risk-Taking: Entrepreneurship encourages individuals to take calculated risks, leading to new discoveries, innovations, and economic progress.

(vii) Diversification of Economy: Entrepreneurship enables the development of new industries and sectors, reducing dependence on a single industry and making the economy more resilient.

(viii) Increased Export: Entrepreneurial ventures can lead to increased export of goods and services, generating foreign exchange and boosting economic growth.

(ix) Encourages Self-Reliance: Entrepreneurship promotes self-reliance, reducing dependence on government jobs and encouraging individuals to take charge of their economic well-being.

(x) Role Model Effect: Successful entrepreneurs serve as role models, inspiring others to pursue entrepreneurial ventures, creating a multiplier effect on economic growth.

(4a)

Drawing: Drawings refer to the money or assets taken out of the business by the sole proprietor for personal use. In the balance sheet of a sole proprietorship, drawings are treated as a reduction in the owner’s equity. They are not considered a business expense but are recorded as a decrease in the owner’s capital account.

(4b)

Creditors: Creditors are entities to whom the sole proprietor owes money for goods or services purchased on credit. In the balance sheet of a sole proprietorship, creditors are shown as a liability. This represents the amount owed to external parties and is listed under the current liabilities section of the balance sheet.

(4c)

Debtors: Debtors are individuals or entities who owe money to the sole proprietor for goods or services provided on credit. In the balance sheet of a sole proprietorship, debtors are considered assets known as accounts receivable. They represent the money owed to the business by customers and are listed under the current assets section of the balance sheet.

(4d)

Accruals: Accruals refer to expenses or revenues that have been incurred or earned but have not yet been recorded in the financial statements. In the balance sheet of a sole proprietorship, accruals are typically recorded as current liabilities if they are expenses or current assets if they are revenues. They represent obligations or incoming funds that are expected to be settled shortly.

(4e)

Stock: Stock refers to the goods or inventory that a sole proprietor holds for sale in the course of business. In the balance sheet of a sole proprietorship, stock is considered a current asset and is typically listed under the inventory or stock-in-trade section. It represents the value of products that are available for sale and yet to be converted into revenue.

Book keeping questions and answers

I need help

I need help for questions and answers

I need help in biology maths chemistry physics english agriculture

Please I need your help Sir

Waec runs

Waec book keeping questions and answers

Pls answers

Please sir I need English, chemistry, physics, biology and maths

I need for physics theory and objectives