Welcome to “Naijaclass Academy“ For Waec 2025 Economics Questions Paper Expo – How you can get our sure question and solution before exam day.

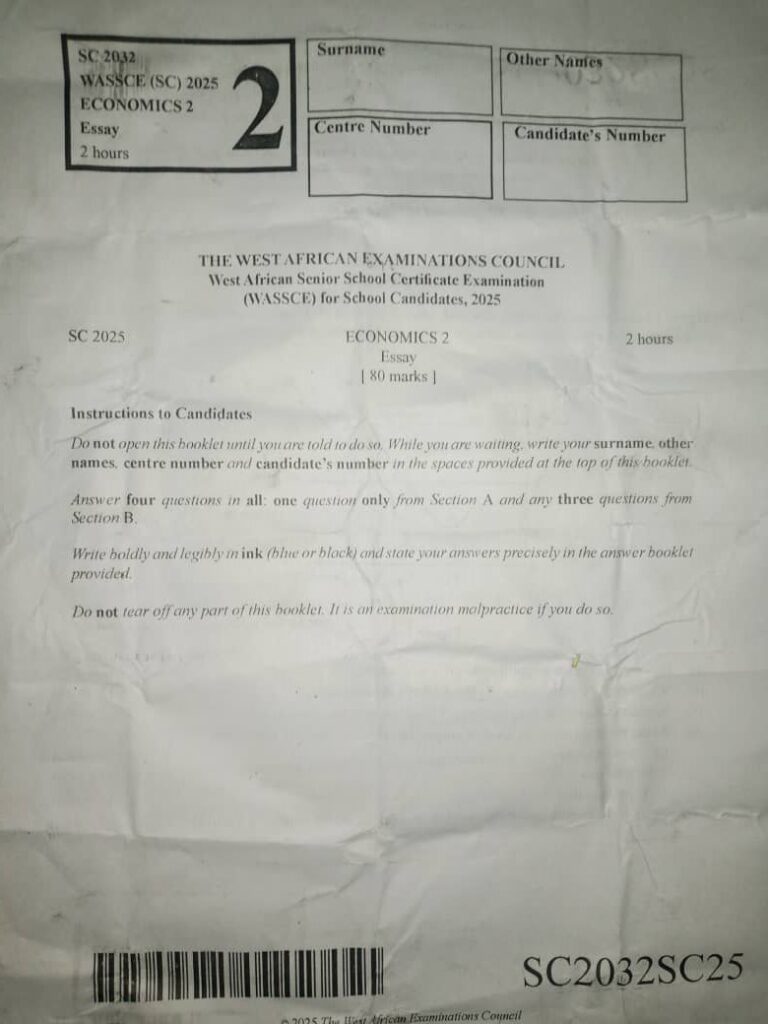

Waec 2025 Economics Questions Paper Expo

Wednesday, 4th June 2025

Economics 2 (Essay): 9:30am – 11:30am

Economics 1 (Objective): 11:30am – 12:30pm

——————————

CONOMICS OBJ: TRACE THE CORRECT PICKED ANSWER

*ECONOMIC -OBJ*

1.indirect taxes.

2.buying more raw materials.

3.high degree of uncertainty.

4.offer more than one product from various sectors for export.

5.higher than marginal revenue.

6.balance of payments.

7. inferior goods

8. average cost curve

9. S

10. average fixed cost

11. gives incentives for innovation

12. Its holders are creditors to the company

13. Complete independence of each nation

14. Capital account section

15. buying more at a higher price

16. C. fixing production quotas for all member countries.

17. peasant farming.

18. legally exploit the loopholes in tax laws to pay less tax.

19. Shareholders’ funds.

20. rice has a greater opportunity cost of production than maize.

21. price inelastic.

22. structural unemployment.

23. specific tax.

24. consume less to increase marginal utility.

25. cause the value of money to rise

26. has few substitutes

27. central planning committee

28. R

29. technical economies

30. reducing or removing export duties

31. source of raw material

32. Consumers income level

33. lower than proposed expenditure

34. vertically sloped

35. it is recognized as a corporate entity

36. decreases

37. geographical mobility of labour

38. subsidy on farm equipment has increased

39. real composition of output is not fully known

40. resources are inadequate

41. Promissory notes

42. an increase in equilibrium quantity while equilibrium price is fixed

43. its total surface area cannot be changed

44. Component bar chart

45. shut down completely

46. supply of goods to decrease

47. marginal product of the variable factor rises and later falls

48. encourage cassava farmers

49. unemployment in the importing country

50. inclusion of wages of house-keepers

========================

=====================

THEORY ANSWERS

SECTION A:

Answer only one (1) Question from this section

Section A consist of Question 1 & 2 only (Pick any one)

=================================================

========================================

====================================

SECTION B:

Answer three (3) Questions from this section

Number 3 – 8 questions

======================================

(4a) Minimum price control : The minimum price control are the lowest prices by law,

below which the specified goods and services cannot be sold or bought. Minimum prices

may be fixed on commodities if the aim is to protect producers (especially agricultural

producers) from the income fluctuation brought about by poor harvests.

(4b) (PICK ANY THREE)

(i)To Encourage Increased Production: Farmers will be motivated to produce more when they are sure of a guaranteed minimum price. This helps reduce fear of losses due to price crashes, especially during harvest seasons when produce tends to flood the market.

(ii) To Protect Farmers from Exploitation: Middlemen and large buyers often take advantage of farmers by offering them very low prices. With a government-set minimum price, farmers are protected from being cheated, especially small-scale rural farmers.

(iii) To Stabilize Farmers Income: Agriculture is very risky due to price fluctuations and seasonal changes. A minimum price policy helps stabilize farmers’ earnings, making their income more predictable and improving their standard of living.

(iv) To Ensure Food Security: When farmers are assured of fair returns, they are more likely to continue farming. This contributes to national food production, thereby improving food supply and reducing hunger or reliance on imported food.

(v) To Prevent Rural-Urban Migration: Many farmers leave the villages because farming doesn’t pay. With better prices for their crops, more farmers will be encouraged to stay in rural areas, reducing congestion and unemployment in urban cities.

(4c) (PICK ANY THREE)

(i) Surplus or Excess Production: When the minimum price is set above the natural market price, farmers tend to produce more than what the market can absorb. This leads to excess supply, which the government may not be able to buy or store.

(ii) High Cost of Storage and Preservation: The government may need to store large quantities of unsold produce to prevent waste. This comes with high costs for warehousing, transportation, and preservation—especially in countries with poor storage infrastructure.

(iii) Wastage of Perishable Goods: Many agricultural products like tomatoes, fruits, and vegetables are perishable. If they are not sold or stored quickly, they spoil. In such cases, minimum price policies can lead to large-scale food waste.

(iv) Financial Burden on the Government: Buying excess produce to support the minimum price requires a lot of public funds. This can place a huge financial burden on the government, diverting money from other critical sectors like education and health.

(v) Encouragement of Inefficiency Among Farmers: Knowing they will get a fixed price, some farmers may not put in the effort to improve the quality or efficiency of their farming. This can lead to poor-quality produce and low productivity in the sector.

(vi) Possibility of Corruption and Mismanagement: Government involvement in buying and storing surplus produce can open doors for corruption. Officials may inflate prices, divert produce for personal gain, or mismanage public resources meant for farmers.

===============================

(5a)

Production costs refer to all the expenses a firm incurs in the process of producing goods or services. These include payments for raw materials, labor, machinery, rent, utilities, and other inputs necessary for production.

(5b)

Real cost includes the total effort, sacrifice, and resources used in production, including opportunity costs while explicit cost refers to the actual financial payments made during production, such as wages and rent.

(5c)

Fixed Input refers to inputs in production whose quantity does not change with the level of output in the short run. For example, the size of a factory or the number of machines remains constant regardless of how much is produced WHILE variable Input refers to inputs whose quantity varies directly with the level of output. For instance, raw materials and labor hired on an hourly basis increase as production increases.

(5d)

(i) Fixed Cost:

These are costs that do not change with the level of output. Whether production is high or low, fixed costs like rent and salaries remain constant.

(ii) Variable Cost:

These are costs that vary directly with output. As production increases, expenses like raw materials and electricity also rise.

(iii) Total Cost:

This is the sum of fixed and variable costs. It represents the overall expense incurred in producing a given level of output.

(iv) Marginal Cost:

This is the additional cost of producing one more unit of output. It helps firms decide whether increasing production is profitable.

=========================================

(6a) A monopoly is a market structure where a single firm dominates the entire market, controlling the supply of a product or service with no close substitutes.

(6b) (i) Barriers to Entry: High startup costs, patents, or government regulations can prevent new firms from entering the market.

(ii) Control of Resources: A single firm may own or control a crucial resource, limiting others’ ability to compete.

(iii) Government Intervention: Governments may grant exclusive rights or licenses to a single firm, creating a monopoly.

A monopolist can earn supernormal profits due to their market power. In the diagram, the monopolist’s profit-maximizing output is where MR = MC. At this output, the price (P) is higher than the average total cost (ATC), resulting in supernormal profits (shaded area).

=======================================

7a) (PICK ANY THREE)

(i) Treasury Bills

(ii) Commercial Papers

(iii) Certificates of Deposit

(iv) Repurchase Agreements (Repos)

(v) Bankers’ Acceptances

(vi) Call Money

(7bi) Money Market: A manufacturer will seek short-term funds from the money market to meet immediate or temporary financial needs such as purchasing raw materials, paying workers’ salaries, or financing daily operations.

Example: A manufacturer facing a cash flow gap before receiving payment from customers may use a treasury bill or commercial paper for short-term financing.

(7bii)

Capital Market: A manufacturer will seek long-term funds from the capital market to finance major projects such as expansion, purchase of machinery, construction of a new factory, or acquisition of fixed assets.

Example: A manufacturer may issue bonds or shares to raise funds for building a new production plant.

(7c)

(PICK ANY THREE)

(i) Provision of long-term loans: Development banks provide long-term financing to sectors like agriculture, industry, and infrastructure.

(ii) Promotion of industrial development: They support the establishment and growth of industries, especially in underdeveloped areas.

(iii) Financing capital projects: They fund major projects such as power plants, roads, and housing, which may not attract private investment.

(iv) Technical and managerial assistance: Development banks offer advisory services and training to entrepreneurs.

(v) Support for small and medium enterprises (SMEs): They provide credit and support to small businesses that struggle to get loans from commercial banks.

==============================================

(8a)

A regressive system of taxation is one in which the tax rate decreases as the taxpayer’s income increases. This means that lower-income earners pay a higher percentage of their income in taxes compared to higher-income earners. It places a greater burden on the poor than the rich.

(8bi)

Economy: This principle emphasizes that the cost of collecting a tax should be low relative to the revenue generated. The tax system should not require excessive administrative expenses or burden the taxpayers unnecessarily.

(8bii)

Certainty: This principle means that taxpayers should know exactly how much tax they are expected to pay, when to pay it, and how to pay it. The rules should be clear, consistent, and not arbitrary to avoid confusion and abuse.

(8biii)

Equity: Equity means fairness in taxation. It implies that individuals should pay taxes based on their ability to pay. The rich should contribute more than the poor (vertical equity), and those in similar financial situations should pay similar taxes (horizontal equity).

(8c)

(PICK ANY THREE)

(i) To raise revenue for government expenditure.

(ii) To redistribute income and reduce inequality.

(iii) To control inflation by reducing disposable income.

(iv) To protect local industries (e.g., through import duties).

(v) To discourage the consumption of harmful goods (e.g., tobacco, alcohol).

(vi) To influence investment decisions.

(vii) To fund infrastructure and public services.

=====================================

=================

It is important to note that Naijaclass.com is the only website that has the above listed 2025 Waec Expo Daily Subscription Package. However, any website who copy any of the packages listed above will be reported for content theft and have their site removed from Google and other search engines.

==================

Tnx pls obj answers

Economics

Goodday Pls we answer

Hi please the pin

I NEED PIN FOR ECONOMICS

Please i need economics questions and answer and the pin also

Theory answer

Please what time will economics be out

Please drop economics for me

Please drop the obj answer

Please drop the obj answer

I need economic

Waec 2025 !!!!

DONE AND DUSTED !!!!!

Waec 2025 !!!

DONE AND DUSTED !!!!!!!

Waec 2025 !!!

DONE AND DUSTED !!!!!

Thank God for a successful exam !

Economics was out