Welcome to “Naijaclass Academy“ For Neco GCE 2025 Economics Questions Answers Expo

Wednesday 10 December

Economics III (Objective) – 10:00 am – 11:00 am

Economics II (Essay) – 11:00 am – 1:00 pm

========================================

ECONS OBJ

01-10: DEABBACDED

11-20: BEBEBCCCBD

21-30: CEEECCAABC

31-40: EEEADCCDCA

41-50: CBCEDCACAC

51-60: DABEBAABBD

Neco GCE 2025 Economics Questions Answers Expo

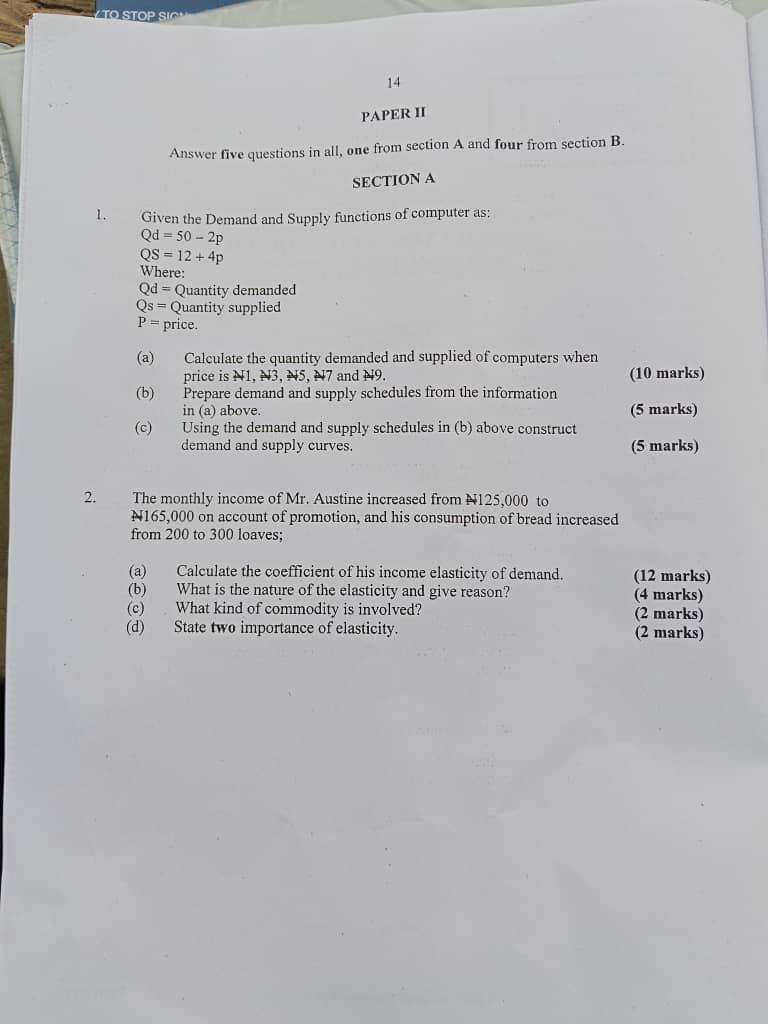

(2a)

Initial Income (Y₁) = ₦125,000

New Income (Y₂) = ₦165,000

Initial Quantity (Q₁) = 200 loaves

New Quantity (Q₂) = 300 loaves

Change in Income = 165,000 – 125,000 = ₦40,000

Change in Quantity = 300 – 200 = 100 loaves

Percentage Change in Quantity =

100/200 × 100 = 50%

Percentage Change in Income =

40,000/125,000 × 100 = 32%

YED = 50/32 =1.56

Therefore, the coefficient of income elasticity of demand = 1.56

(2b)

The elasticity of demand is income elastic.

Reason: Since the coefficient (1.56) is greater than 1, demand increases more than proportionately with increase in income.

(2c) Bread is a normal good (necessary commodity) because demand for it increases as income increases.

(2d)

(PICK ANY TWO)

(i) It helps the government in fixing taxation policies.

(ii) It helps producers in fixing the prices of goods.

(iii) It helps businessmen to predict changes in demand.

(iv) It is useful in wage determination.

(v) It guides producers on how much to produce.

(vi) It helps in understanding consumer behaviour.

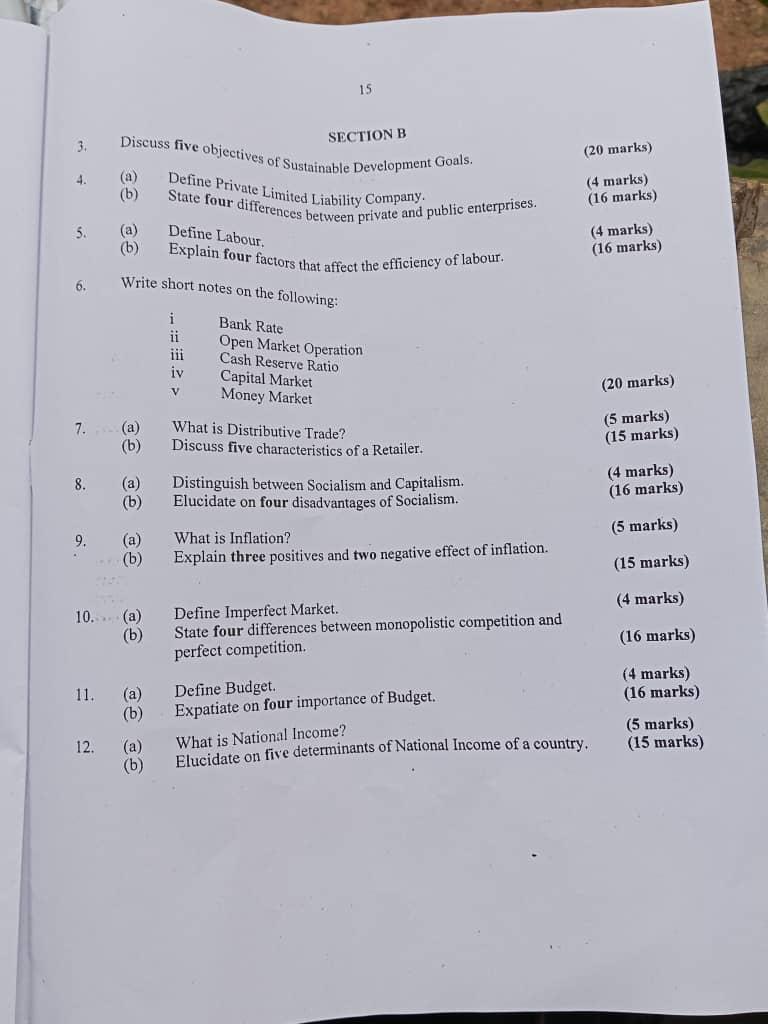

NECO GCE ECONOMICS

NUMBER THREE

(3)

(PICK ANY FIVE)

(i) No Poverty: One major objective of the Sustainable Development Goals is to end poverty in all its forms everywhere in the world. This includes ensuring that people have access to basic needs such as food, shelter, education and healthcare. It also aims at providing social protection and empowerment for the poor and vulnerable.

(ii) Zero Hunger: This objective focuses on ending hunger and ensuring food security for all people. It also promotes improved nutrition and supports sustainable agriculture to ensure that everyone has access to enough safe and nutritious food at all times.

(iii) Good Health and Well-being: The SDGs aim to ensure healthy living and promote well-being for people of all ages. This includes reducing maternal and child mortality, fighting diseases such as malaria and HIV/AIDS, and improving access to quality healthcare services.

(iv) Quality Education: Another objective of the SDGs is to ensure inclusive and equitable quality education for all and promote lifelong learning opportunities. It focuses on improving access to schools, reducing illiteracy and ensuring that both children and adults acquire relevant skills and knowledge.

(v) Gender Equality: This objective seeks to achieve equality between men and women and empower all women and girls. It aims at eliminating all forms of discrimination and violence against women, ensuring equal access to education, employment and leadership opportunities.

(vi) Clean Water and Sanitation: The SDGs aim to ensure the availability and sustainable management of clean water and sanitation for all. This includes providing access to safe drinking water, proper toilet facilities and promoting good hygiene practices.

(vii) Affordable and Clean Energy: This objective focuses on ensuring access to affordable, reliable and clean energy for everyone. It promotes the use of renewable energy sources such as solar and wind power to reduce environmental pollution and support sustainable development.

(viii) Climate Action: The SDGs also aim to take urgent action to combat climate change and its impacts. This includes reducing greenhouse gas emissions, promoting environmental protection and encouraging countries to adopt sustainable practices to protect the planet.

NECO GCE ECONOMICS

NUMBER FOUR

(4a)

A Private Limited Liability Company is a business organisation owned by a small number of people, whose liability is limited to the amount of capital they invested in the business. Its shares are not offered for sale to the general public and ownership is restricted.

(4b)

(PICK ANY FOUR)

(i) In a private enterprise, ownership belongs to private individuals or groups of individuals who invest their personal money in the business, WHILE in a public enterprise, ownership belongs to the government on behalf of the citizens.

(ii) In a private enterprise, the main aim is to make maximum profit for the owners, WHILE in a public enterprise, the main aim is to provide essential goods and services to the public even if little or no profit is made.

(iii) In a private enterprise, capital is provided by individuals, partners or private shareholders, WHILE in a public enterprise, capital is provided by the government through public funds and taxation.

(iv) In a private enterprise, management is controlled directly by the owners or their managers, WHILE in a public enterprise, management is controlled by government-appointed officials and boards.

(v) In a private enterprise, goods and services are produced mainly for people who can afford to pay, WHILE in a public enterprise, goods and services are produced for the general public at affordable prices.

(vi) In a private enterprise, efficiency is usually high because of competition, strict supervision and the desire to make profit, WHILE in a public enterprise, efficiency is often low due to lack of competition, bureaucracy and poor supervision.

(vii) In a private enterprise, profits belong to the owners and losses are also borne by the owners, WHILE in a public enterprise, profits go to the government and any losses are borne by the government and taxpayers.

NECO GCE ECONOMICS

NUMBER FIVE

(5a)

Labour refers to the physical and mental efforts of human beings used in the production of goods and services for the purpose of earning income. It includes all human activities directed toward production, except illegal activities.

(5b)

(PICK ANY FOUR)

(i) Education and Training: The level of education and training of workers greatly affects their efficiency. Well-trained and educated workers perform better, make fewer mistakes and produce more output than untrained workers.

(ii) Health of Workers: A healthy worker is more efficient than a sick one. Good health increases strength, concentration and productivity, while poor health reduces efficiency and leads to frequent absenteeism.

(iii) Working Conditions: Good working conditions such as proper lighting, ventilation, safety measures and comfortable working environment increase the efficiency of labour. Poor working conditions reduce morale and productivity.

(iv) Wages and Salaries: Adequate and regular payment of wages motivates workers to work harder and give their best. Low or irregular wages discourage workers and reduce their level of efficiency.

(v) Motivation and Incentives: Incentives such as bonuses, promotion, allowances and recognition encourage workers to improve their performance and efficiency.

(vi) Availability of Tools and Equipment: Modern tools and machines make work easier, faster and more accurate. Lack of proper equipment reduces the efficiency of labour.

(vii) Experience and Skill: Workers with more experience and higher skills perform their duties better and faster than inexperienced workers, thereby increasing labour efficiency.

NECO GCE ECONOMICS

NUMBER SIX

(6i)

Bank Rate: Bank rate is the interest rate at which the Central Bank lends money to commercial banks and other financial institutions. It is an important tool used by the Central Bank to control the volume of credit in the economy. When the bank rate is increased, borrowing becomes expensive for commercial banks and they in turn lend less to the public, thereby reducing money supply. When the bank rate is reduced, borrowing becomes cheaper and money supply increases, which stimulates economic activities.

(6ii)

Open Market Operation: Open Market Operation refers to the buying and selling of government securities such as treasury bills and bonds by the Central Bank in the open market. It is used to regulate the supply of money in the economy. When the Central Bank sells securities, money is withdrawn from circulation and money supply reduces. When it buys securities, money is released into the economy, thereby increasing money supply and encouraging investment and spending.

(6iii)

Cash Reserve Ratio: Cash Reserve Ratio is the proportion or percentage of commercial banks’ total deposits that must be kept with the Central Bank as a compulsory reserve. This tool is used to control the lending power of banks. When the CRR is increased, banks have less money to lend, and money supply reduces. When the CRR is lowered, banks can lend more money to the public, thereby increasing money supply in the economy.

(6iv)

Capital Market: The capital market is the financial market where medium-term and long-term funds are raised and invested. It deals in long-term financial instruments such as shares, debentures, bonds and government stocks. The capital market provides funds for the establishment and expansion of industries and businesses. It also promotes economic development by encouraging savings and investment and by providing employment opportunities.

(6v)

Money Market: The money market is a financial market where short-term funds are borrowed and lent, usually for periods not exceeding one year. It deals in short-term financial instruments such as treasury bills, commercial papers, bank overdrafts and call money. The money market helps businesses and the government to meet their short-term financial needs. It also helps in maintaining liquidity and stability in the financial system.

NECO GCE ECONOMICS

NUMBER SEVEN

(7a)

Distributive trade is the branch of commerce concerned with the buying and selling of goods and services and the movement of goods from the producer to the final consumer. It includes all activities that make goods available to those who need them at the right place and time.

(7b)

(PICK ANY FIVE)

(i) Sells in Small Quantities: A retailer sells goods in small units or quantities to the final consumers for personal or household use. Unlike wholesalers who sell in bulk, the retailer breaks bulk and makes goods available in convenient quantities that consumers can easily afford.

(ii) Buys from Wholesalers or Producers: A retailer usually buys goods from wholesalers and sometimes directly from producers. He then adds his own profit and resells the goods to the final consumers. This makes the retailer an important link between wholesalers and consumers.

(iii) Deals Directly with Consumers: A major feature of a retailer is that he maintains direct contact with the final consumers. He understands their needs, tastes and preferences and supplies goods that can satisfy those needs.

(iv) Requires Small Capital: Retail business usually requires small capital when compared with wholesaling and manufacturing. Many people can easily set up retail shops with little money, especially petty traders and small shop owners.

(v) Gives Personal Services to Customers: A retailer provides personal services such as advising customers on the choice of goods, granting credit facilities, home delivery services, and sometimes after-sales services. These services help to attract and retain customers.

(vi) Located Close to Consumers: Retail shops are usually located near residential areas, markets and busy streets so that consumers can easily buy goods without travelling long distances. This makes buying and selling convenient for consumers.

(vii) Bears Risk of Loss: A retailer bears many risks such as theft, spoilage of perishable goods, bad debts from customers who buy on credit, fire outbreaks and price fluctuations. All these risks are part of retail business.

NECO GCE ECONOMICS

NUMBER EIGHT

(8a)

Socialism is an economic system in which the means of production such as land, industries and natural resources are owned and controlled by the government for the benefit of all citizens, WHILE capitalism is an economic system in which the means of production are owned and controlled by private individuals for profit.

(8b)

(PICK ANY FOUR)

(i) Lack of Incentive to Work Hard: Under socialism, workers are paid almost equally regardless of effort or performance. This discourages hard work and excellence because nobody is specially rewarded for extra effort. As a result, productivity is usually low.

(ii) Inefficiency in Management: Most industries and enterprises are owned and managed by the government. Because government officials do not personally own these businesses, they may not manage them efficiently. This often leads to corruption, waste, mismanagement and low productivity.

(iii) No Freedom of Choice for Consumers: In a socialist system, the government decides what goods to produce, how much to produce and how they are distributed. Consumers therefore have limited choices in the market and cannot freely choose the variety or quality of goods they want.

(iv) Slow Decision Making: Due to Bureaucracy

Decision making in socialism is usually very slow because many procedures and approvals must be followed before action is taken. This bureaucratic process delays production, investment and economic growth.

(v) Discouragement of Innovation and Initiative: Since private individuals are not allowed to own major industries or make independent business decisions, creativity and innovation are discouraged. People lack the motivation to invent new ideas because rewards are limited.

(vi) Heavy Financial Burden on Government: The government is responsible for providing employment, housing, education, health care and other social services for the people. This places a heavy financial burden on the government and can lead to budget deficits and heavy borrowing.

(vii) Poor Quality of Goods and Services: Because there is little or no competition among producers, goods and services produced under socialism are often of low quality. Producers do not struggle to improve quality since consumers have no alternative suppliers..

NECO GCE ECONOMICS

NUMBER NINE

(9a)

Inflation is a continuous and persistent rise in the general price level of goods and services in an economy over a period of time, which leads to a fall in the purchasing power of money. It means that more money is required to buy the same quantity of goods and services than before.

(9b)

=Positive Effects of Inflation=

(PICK ANY THREE)

(i) Encourages Production: Inflation leads to higher prices and profits which motivate producers to increase output, thereby boosting production in the economy.

(ii) Promotes Investment: During inflation, businessmen are encouraged to invest more because they expect higher returns on their investments.

(iii) Reduces Burden of Debt: Inflation reduces the real value of money, making it easier for borrowers to repay loans with money that is worth less than when they borrowed it.

(iv) Increases Government Revenue: Government generates more revenue from taxes during inflation because incomes, profits and prices rise.

(v) Encourages Employment: As production and investment increase, more workers are employed, thereby reducing unemployment in the economy.

(vi) Encourages Proper Use of Resources: Inflation discourages hoarding of money and encourages people to invest their money into productive ventures.

=Negative Effects of Inflation=

(PICK ANY TWO)

(i) Fall in Purchasing Power: Inflation reduces the value of money, making it difficult for people, especially salary earners, to afford basic goods and services.

(ii) Causes Economic Uncertainty: Inflation creates uncertainty in the economy as people are unsure of future prices, which discourages long-term planning and savings.

(iii) Worsens Standard of Living: Inflation increases the cost of living, making it hard for people to meet their basic needs such as food, shelter and clothing, especially for low-income earners.

(iv) Discourages Savings: During inflation, the value of money saved in banks decreases, which discourages people from saving and affects capital formation in the economy.

(v) Causes Unequal Distribution of Income: Inflation benefits business owners and borrowers but affects salary earners and fixed-income earners negatively, thereby widening the gap between the rich and the poor.

NECO GCE ECONOMICS

NUMBER TEN

(10a)

An imperfect market is a market situation in which the conditions of perfect competition do not exist. In such a market, there may be few buyers or sellers, products may be differentiated, there may be restrictions to entry and exit of firms, buyers and sellers may have imperfect knowledge of the market, and producers can influence the price of their goods and services.

(10b)

(PICK ANY FOUR)

(i) In monopolistic competition, products are not exactly the same because they are differentiated by brand name, quality, packaging or marketing strategy, which makes consumers prefer one product to another, WHILE in perfect competition, all products are completely identical and homogeneous, so buyers have no reason to prefer one seller’s product over another.

(ii) In monopolistic competition, there are many sellers in the market, but each seller controls only a small share of the total market, WHILE in perfect competition, there are very many sellers producing exactly the same product, and no single seller can influence the market price.

(iii) In monopolistic competition, sellers have some degree of control over the price of their products because of product differentiation, WHILE in perfect competition, sellers have no control over price since price is strictly determined by the forces of demand and supply in the market.

(iv) In monopolistic competition, there is relative freedom of entry and exit of firms, but new firms may face some difficulties due to brand loyalty and high cost of advertising, WHILE in perfect competition, there is complete freedom of entry and exit without any restriction whatsoever.

(v) In monopolistic competition, advertisement plays a very important role because firms spend heavily to promote their products and attract customers, WHILE in perfect competition, advertisement is unnecessary since all products are identical and already well known to buyers.

(vi) In monopolistic competition, buyers and sellers do not have perfect knowledge of the market because information about prices and products may not be freely available to everyone, WHILE in perfect competition, buyers and sellers have perfect knowledge of the market and are fully aware of prices and market conditions.

(vii) In monopolistic competition, the demand curve faced by each firm is downward sloping because a reduction in price can increase sales, WHILE in perfect competition, the demand curve faced by each firm is perfectly elastic (horizontal) because each firm can sell any quantity at the prevailing market price.

NECO GCE ECONOMICS

NUMBER ELEVEN

(11a)

A budget is a financial plan prepared by the government, organisation or individual which shows the estimated income (revenue) and the proposed expenditure for a specific period, usually one year. It serves as a guide for proper financial planning, control and management of resources.

(11b)

(PICK ANY FOUR)

(i) Proper Allocation of Resources: A budget helps the government to distribute scarce resources among various sectors of the economy such as education, health, agriculture, transportation and security based on national needs and priorities to ensure balanced development.

(ii) Control of Public Expenditure: Through the budget, limits are placed on how much government agencies and ministries can spend, thereby preventing waste, reckless spending, corruption and misuse of public funds.

(iii) Tool for Economic Planning: A budget serves as a major instrument for planning the economic activities of a nation. It helps the government to set targets for growth, development, poverty reduction and industrial expansion.

(iv) Promotion of Economic Growth and Development: By allocating funds to productive sectors like agriculture, manufacturing, education and infrastructure, the budget increases production, raises national output and improves the standard of living of the people.

(v) Employment Creation: Government projects such as road construction, school building, hospitals and industries provided for in the budget create employment opportunities for many people and help reduce unemployment.

(vi) Revenue Generation: The budget outlines the expected sources of government income such as taxes, duties, levies, grants and loans which are used to finance public expenditure and development projects.

(vii) Stabilisation of the Economy: A budget is used as a tool for controlling economic problems like inflation and deflation through appropriate government taxation and spending policies to maintain economic stability.

NECO GCE ECONOMICS

NUMBER TWELVE

(12a)

National Income is the total monetary value of all final goods and services produced within a country in a given period of time, usually one year, together with net income from abroad. It also refers to the total income earned by the factors of production, land, labour, capital and entrepreneurship, within a country in a year.

(12b)

(PICK ANY FOUR)

(i) Natural Resources: The quantity and quality of natural resources such as land, minerals, water and climate affect the productive capacity of a country. Countries with abundant and well-utilized natural resources tend to have higher national income.

(ii) Labour Force (Human Resources): The size, education, skill and productivity of the labour force determine the level of output. A skilled and healthy workforce increases production and national income.

(iii) Capital Formation: This refers to the availability of machines, tools, factories, roads and equipment used in production. The higher the capital formation, the higher the productive capacity and national income.

(iv) Level of Technology: Advanced technology improves efficiency, reduces cost of production and increases output, thereby raising national income.

(v) Political Stability and Good Governance: A stable political system encourages investment and ensures effective implementation of economic policies, which leads to higher national income.

(vi) Market Size and Demand: A large population with high purchasing power increases demand for goods and services, which stimulates production and increases national income.

(vii) Entrepreneurship and Management: Entrepreneurs organize production and take risks. Efficient management and innovation improve productivity and thus increase national income.

Be the first to comment